If you want to buy Bitcoin, Ethereum, and other popular cryptocurrencies, you may not know where to start. Before purchasing crypto assets, it is important to check online review sites for reviews of the best sites to buy cryptocurrencies, including their fee structure, payment methods, trading platform features, and wallets for securely storing purchased crypto tokens.

In this complete guide to buying cryptocurrency, we’ll explore the ins and outs of cryptocurrency and the best places to buy cryptocurrency to ensure you’re buying safely on regulated exchanges in 2024 and are not affected by any of the “crypto contagion,” bankruptcy, or insolvency issues that have previously affected defunct sites like FTX.

A Quick Guide to Buying Cryptocurrency

Do you want to buy cryptocurrencies like Bitcoin right now? If so, you can get started by following these four quick steps.

Open an account: First, you need to open an account with a trusted cryptocurrency broker. We recommend using the Coinbase platform as it offers a variety of fiat currency deposit options and has low transaction fees.

Upload Proof of Identity: Due to compliance requirements, Coinbase will require you to upload a copy of your government-issued identification.

Deposit: Depending on your country, you can deposit using a debit/credit card, Paypal, Apple Pay, SEPA or bank wire.

Buy Crypto: Search for any cryptocurrency of your choice and click “Buy”.

Best Cryptocurrency Exchanges of 2024

Invertir

Invest

$

=

Bitcoin

Actualizar

More filters

Close filter

Sort by rating

price

1

Providers matching your filter criteria

Providers matching your filter criteria

Payment Methods

Bank transfer

credit card

Giropay

Neteller

Paypal

Sepa transfer

Skrill

Sofort

Function

Instant Verification

Suitable for beginners

Wallet Services

Mobile Apps

Ease of use

very good

good

generally

Difference

support

very good

good

generally

Difference

Rating

1

or higher

Security

1

or higher

Currency Selection

1

or higher

Classification

1

or higher

Remove filter

Apply filters

No results found

Try adjusting your filters to see some results.

Rating

The quantity purchased with $1000 is

0.0599

BTC

What we like

Easiest deposit

Most regulated

Copy Trading Winners

Rating

Security

Currency Selection

Function

Payment Methods

The quantity purchased with $1000 is

0.0599

BTC

Read Review

Visit website

Read Review

Do not invest in crypto assets unless you are prepared to lose all the money you invest.

How to Buy Cryptocurrency – Coinbase Tutorial

Acquiring cryptocurrency can be a hassle if you want to but don’t use the right platform. For beginners, we recommend using the Coinbase platform to buy and sell cryptocurrency. In this section, we’ll look at methods on how you can buy cryptocurrency in just five minutes:

Step 1: Open a brokerage account at Coinbase

To get started, visit the official website of the Coinbase platform and create a free account.

You will be redirected to the registration page where you will be asked to provide your name, email address, and password.

Step 2: Verify your identity

The next step is to verify your identity. Every new user needs to complete the Know Your Customer (KYC) process to verify their account.

This requires providing copies of the following documents:

Passport, driving license or national identity card

Utility bill or bank statement issued within the last 3 months

In most cases, Coinbase will verify your documents immediately and remove any account restrictions afterwards.

Step 3: Deposit money into your account

To start trading, you need to fund your Coinbase account. The minimum deposit amount is $50. In addition, Coinbase offers a variety of payment methods to make the process easier for you.

You can choose from the following options:

Debit/Credit Card (Visa, MasterCard, Maestro)

Paypal

Apple Pay/Google Pay

Local bank transfer (depending on the country)

International Bank Wire

Step 4: Buy Cryptocurrency

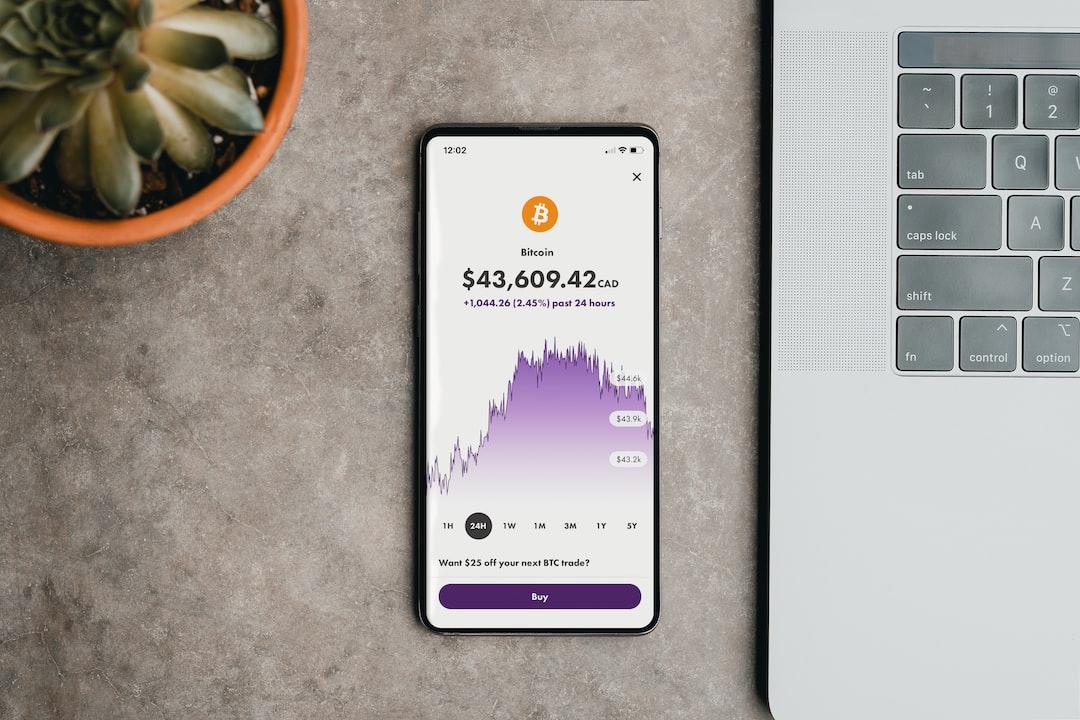

The last step is to buy the cryptocurrency you want. Coinbase allows you to choose from over 200 cryptocurrencies. You can buy Bitcoin, Ethereum, ADA, and even Dogecoin. To get started, go to the search bar and type in the name of the cryptocurrency you want to buy.

For example, if you want to buy Ripple or Bitcoin, you can type "XRP" or "BTC" into the search bar and click on the first result that appears. Once on the asset page, you can click on the "Statistics" button to view the financial records of the digital asset.

To complete the purchase process, click the "Buy" button.

Best Places to Buy Cryptocurrency – Exchange Reviews

As the popularity of cryptocurrencies grows, the number of platforms that provide access to these assets is also growing. Today, there are thousands of platforms where you can buy cryptocurrencies. However, this creates a problem for traders. Finding the best platform to buy cryptocurrencies can be challenging, especially for first-time traders. To save you the time and effort spent on research, we have done a lot of platform reviews and concluded the best places to buy cryptocurrencies.

Below are reviews of cryptocurrency platforms that have been carefully considered for security. These platforms also store your digital assets securely and adhere to standard Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

1. Coinbase – Largest cryptocurrency exchange in the United States

Coinbase is a cryptocurrency exchange that caters to cryptocurrencies. As a publicly listed exchange, it is very popular among cryptocurrency investors due to its user-friendly trading platform.

Founded in 2012, Coinbase offers popular cryptocurrencies, altcoins, and staking.

The Coinbase platform is aimed at new cryptocurrency traders. It offers different platforms for specific users. More experienced traders prefer the Coinbase Pro platform, which will become the "Advanced Trading" platform in 2024, which offers lower fees and more trading tools.

Coinbase is one of the five largest cryptocurrency exchanges, provides cryptocurrency custody services to institutions, and has listed its COIN shares on the Nasdaq.

advantage

Good user interface for novice traders

High liquidity

Low minimum balance

A good option for altcoin trading

Public listing

shortcoming

High costs

No credit card payment options

Visit Coinbase

2. Kraken – The 3rd Largest Cryptocurrency Exchange

Kraken was founded by its current CEO Jesse Powell and is owned by Payward Inc. It is one of the earliest cryptocurrency exchanges, founded in 2011. After its official launch in 2013, Kraken quickly gained recognition thanks to its high-quality products. At the time of writing, it is the third largest cryptocurrency exchange by trading volume and a well-known name in the industry.

The exchange serves more than 8 million users and institutions worldwide and has offices around the world. It is headquartered in San Francisco and is backed by some of the largest VCs in the financial sector. Kraken carries over 120 cryptocurrencies and always makes sure to feature top projects on its list. It has three major stablecoins, including USDC, USDT, and DAI. Kraken is also the only exchange to support multiple fiat currencies, with seven options in total, which is a major advantage for investors.

Kraken has a pro version that can be used to pay lower fees and access advanced trading products. Since all assets are stored in cold wallets and monitored 24 hours a day, it is also very secure, with armed personnel providing security protection.

advantage

High security

Supports seven major fiat currencies

Reputable company

The third largest cryptocurrency exchange

shortcoming

Higher fees when using the basic Kraken exchange

Limited choice of equity cards

Average customer service

Visit Kraken

3. OKX – Good Crypto Exchange to Buy Over 350 Crypto Assets

Founded in 2017, OKX is a cryptocurrency exchange based in Seychelles. The platform initially had limited functionality, but during the 2021-2023 period, it added a number of features that allow users to diversify their investments. In terms of trading, OKX supports conversions, spot trading, margin, and derivatives trading. P2P trading capabilities are also available. While OKX used to be a crypto-only exchange, it has recently added support for fiat currency payments, allowing users to purchase cryptocurrencies using over 100 fiat currencies.

OKX allows users to discover markets and opportunities based on their areas of interest. For example, if users are looking for the best metaverse or gaming projects to invest in, they can find these projects through the platform. OKX also has an earning program that allows users to earn an annual return (APY) through staking and an annual percentage rate of return (APR) through savings accounts. Cryptocurrency lending as well as copy trading are also one of the highlights of OKX.

To buy cryptocurrencies on OKX, users are charged based on order maker/taker fees, which range from 0.080%/0.1% to 0.060%/0.080%. The fees charged are divided into several tiers that are specific to the amount of OKB tokens held by the user. VIP users with assets exceeding $100,000 have lower fees.

advantage

Copy trading available

Provides staking and savings accounts

Low fees, which can be further reduced by holding OKB tokens

Copy trading available

Support spot trading, futures trading, margin and derivatives trading

Simple interface

shortcoming

A large amount of OKB tokens is required to keep fees low

Not available in the United States

Visit OKX

4. Bybit – Beginner-friendly Crypto Exchange with Huge Bonuses for First-time Traders

Bybit was founded in 2018 and started out as a small cryptocurrency exchange. However, as time went on and more crypto assets came in, Bybit started adding more utility, including more trading features and tools to make cryptocurrency investing viable for investors.

Many of Bybit’s features are geared toward beginners, including a one-click buying option. P2P trading is also available, allowing users to buy and sell cryptocurrencies with other parties with zero fees.

The platform also provides various market data through its overview, which categorizes the best gainers, losers, and leading investors. The platform also frequently lists new projects, and Bybit has gained a lot of reputation for being one of the first exchanges to accept new projects for listing.

Bybit has implemented a nuanced fee strategy based on differentiated charges for VIP and non-VIP users. The fee rates for VIP users range from 0.06%/0.04% to 0.1%, while the fee rates for non-VIP users range from 0.1% to 0.03%.

Security is a major concern for this cryptocurrency exchange, which has prompted it to create a three-layer security module. It also has an audited credential proof that all user assets on its platform are 1:1. Users who create an account on the platform receive a bonus of 5,030 USDT.

advantage

Beginner-friendly user interface

Provide a variety of trading options

Low transaction fees

Copy trading available

Features multiple Web 3 elements, including NFTs

With earning program

shortcoming

Not available in the United States

Visit Bybit

5. Huobi – A Reputable Place to Buy Cryptocurrency

Huobi has been operating since the early days of cryptocurrency. A long-standing and well-known brand in the cryptocurrency space, it was founded in 2013.

During this time, Huobi (also known as Huobi Global) has never been hacked, nor has there been any issues with user data or funds. When the Bitmart exchange was hacked, Huobi and the Shiba Inu community collaborated to provide assistance.

Huobi offers spot and leveraged trading, which means that in addition to buying cryptocurrencies, you can also go long or short cryptocurrencies on the platform, taking advantage of leverage. It offers up to 200x leverage on certain assets, which is more than most cryptocurrency exchanges.

A unique feature of Huobi is that it offers free use of a cryptocurrency trading bot that uses a "grid trading" system. Currently, the bot's backtested 7-day annualized return is 44%, and this ROI performance data is updated weekly.

It also offers high-yield crypto staking, up to 50% APY on multiple assets, crypto lending, and welcome bonuses.

advantage

Operated for ten years without being hacked

Cryptocurrency staking

Grid Trading Robot

Spot and leverage trading

shortcoming

No social trading/copy trading

0.2%’s order placing/taking fee is higher than Binance and Coinbase Pro

Visit Huobi

6. Crypto.com – Crypto Debit Card and App

Crypto.com, a platform that is both a cryptocurrency exchange and a mobile app, offers a crypto debit card, was founded in 2016 and has celebrities such as Matt Damon in its TV commercials. It has also signed sponsorship deals with F1 racing (Formula One), UFC, and various sports teams.

Currently, U.S. traders can use the app and VISA debit cards, but not the exchange platform, although this may change in the future. Crypto.com Exchange offers spot, leveraged, and derivatives trading.

Crypto.com's metal prepaid card earns up to 8% in crypto cashback on purchases, and on the platform, you can earn up to 14.5% in annual yield on crypto assets, with stablecoins such as USDC offering the highest interest rates. You can also participate in farm and stake DeFi protocols, like Huobi, and apply for crypto loans.

Crypto.com supports over 250 cryptocurrencies and has over 10 million users. It also has its own NFT marketplace where you can create, display, sell and buy non-fungible tokens.

advantage

Crypto assets can earn up to 14.5% interest per year

NFT Market

DeFi Staking

Crypto Debit Cards and Wallets

shortcoming

Some restrictions on U.S. investors

Higher spreads

Visit Crypto.com

7. Evonax – Cryptocurrency Exchange with No KYC or Registration Required

Evonax is a global cryptocurrency exchange that allows users to exchange cryptocurrencies without registering or providing any KYC. Trade between 18 of the most popular cryptocurrencies on the market on a simple and intuitive user interface.

Evonax firmly believes that anonymity is everyone's right and takes your privacy seriously. All of this is backed by 24/7 support so you are always in safe hands.

Evonax provides its users with a very simple three-step process. First, select the coins you own and the coins you want, as well as the amount, and provide the wallet address where you want to receive the desired coins.

Secondly, transfer the coins you own to the unique wallet address generated and wait for the blockchain network to confirm the transaction. Thirdly, receive the coins to your wallet address.

advantage

Easy to use

No registration or KYC required

Instant transfer

Good customer support service

shortcoming

Only 18 cryptocurrencies available

No wallet service

No live chat support

Visit Evonax

8. Libertex – Best Broker for Stocks and CFDs

Libertex was founded in 1997 and has over 20 years of experience in online trading services. It is regulated by CySEC and is one of the companies in the Libertex Group. With more than 2 million active users in 120 countries, Libertex allows trading indices, cryptocurrencies, stocks, commodities and forex at the click of a button.

Users can choose between MetaTrader 4 (MT4) and Libertex Web Trader, a trading platform they are familiar with. It is known for its zero-spread pricing structure and offers investment opportunities in 250 financial instruments. Advanced traders can also enjoy privileges such as margin trading with a leverage of 1:30.

Libertex offers negative balance protection, which protects users from inadvertent liquidation of their accounts. In addition, its brokerage fee is 0.006%, one of the lowest in the industry, and users can enjoy a rich trading experience.

New accounts require a minimum deposit of $100, with regular deposits of $10. Deposits can be made via a variety of methods including bank transfer, credit/debit cards and e-wallet providers.

advantage

Demo account up to €50,000

Low spreads

24/7 customer support

Negative Balance Protection

Cross-platform trading experience

shortcoming

Limited product portfolio

Variable Spread System

Less educational content

Certain withdrawal methods require fees

Visit Libertex

9. Binance – Best Rated Exchange for Buying Cryptocurrency

Binance is known for one thing: its sheer size. Founded in China, Binance is a rapidly growing cryptocurrency ecosystem. With decentralized exchanges (DEX) like PancakeSwap, Binance is the largest cryptocurrency exchange by volume.

It is also one of the best platforms for trading cryptocurrencies due to its low transaction fees of 0.10%. In addition, if you own its proprietary token BNB, you can enjoy discounted fees when paying with that token.

Binance offers a variety of trading options, and users can engage in margin trading, futures trading, and leverage trading. Binance allows users to purchase cryptocurrencies using fiat currencies and offers more than 300 cryptocurrencies and thousands of trading pairs.

See our page on the best utility coins, one of which is BNB. In addition to cryptocurrency trading, Binance also operates an earning program for passive income.

advantage

Higher liquidity

Low transaction fees

A good platform choice for experienced traders

Largest cryptocurrency exchange

Supports credit/debit card deposits and fiat currencies

shortcoming

Higher fees for using debit/credit cards

Not suitable for novice traders

Visit Binance

Volatility of Crypto Assets

If you’ve been around crypto long enough, you’ve probably heard the term volatility thrown around a lot. This is because cryptocurrencies are extremely volatile. This means you might make a ton of money in one trading session, only to see your gains diminish in the next few minutes.

A prime example is the price of Bitcoin, which has risen more than 1,00% in the past six months to a record high of $64,350, but has struggled to break through the $35K mark in the past few weeks. Critics point to these wild price swings as a reason why cryptocurrencies cannot replace cash.

Nonetheless, cryptocurrencies are an exciting investment class.

To guide your exploration, we recommend checking out expert cryptocurrency review sites (such as ours) that have dedicated teams who work around the clock to give you the best advice on the ever-changing market trends. This will save you a lot of grief as you will be exposed to crypto projects that have growth potential and are proven.

Storing Cryptocurrency

Just like every object, cryptocurrencies need to be stored. Since they are lines of computer code, they cannot be stored in a physical location. You will need a cryptocurrency wallet to keep your crypto funds. In addition to storage, cryptocurrency wallets also allow you to perform other operations such as executing transactions, monitoring market trends, and performing cryptocurrency exchanges almost instantly.

Choosing the right cryptocurrency wallet largely determines the security of your digital assets, so we have selected the best cryptocurrency wallets for both mobile and desktop users.

Selling Cryptocurrency

If you are planning to sell your cryptocurrency, whether because you no longer want to hold a particular crypto asset or because you made a profit from it, the process is just as simple as when you initially purchased it. Since the crypto assets are in a digital wallet, you can easily initiate a withdrawal request.

While there are a variety of ways to sell your cryptocurrency holdings, the best and safest way is to do it through an exchange like Coinbase. This way, you can be sure that your account will be funded if you decide to sell your assets.

Choosing the Right Broker

Previously, it was not easy to buy cryptocurrencies because only a few brokers offered crypto custody services. However, times have changed and cryptocurrencies have become an important market sector. Now, there are multiple trading platforms that offer services related to cryptocurrencies.

As serious as it sounds, this also brings up a new challenge, namely, how to choose the right broker to buy cryptocurrencies? Although the situation may seem daunting, we have selected some criteria to help you in your search.

Brokers are unique in what they offer, and you need to make sure the broker you choose meets the following criteria:

1. Fees

This is the first parameter to consider when choosing a broker. You need to know the fees charged by the cryptocurrency broker for deposits and withdrawals. Another fee to consider is the commission on trades. It is now a norm in the industry for brokers to offer zero commission trading. Platforms like Capital.com offer such an offer. You should also consider the hidden fees that the broker may charge and its inactivity fee structure.

2. Payment Methods

This is also necessary. The more payment channels a broker has, the easier it will be for you to fund your account. Some brokers allow you to buy Bitcoin using PayPal. Others don’t accept credit card deposits, while some may take longer to process bank wires. Keep an eye out for these signs.

3. Cryptocurrency offering

Since we are talking about investing in digital assets, you need to know how many cryptocurrencies the broker supports. Some brokers offer cryptocurrency contracts for difference (CFDs), which means you don’t have to worry about the custody of the underlying assets. If this is useful to you, you should try this type of broker.

4. Security

You need to find out if the broker you choose is a regulated entity. A license from a reputable regulator such as the FCA shows that the broker is safe, meaning your funds will not suddenly disappear. Since the broker will be subject to constant audits, your data will also not be leaked in the event of a breach.

5. Minimum deposit

The minimum deposit is also crucial. You need to know what the minimum financial threshold is that the broker requires new clients to meet. This can be a great way to test your trading strategy with a small capital before investing a large sum of money.

6. Social Trading

Social trading is slowly becoming an industry standard. It is a way for a trading platform to provide traders with the ability to follow the latest market trends and news. This also allows new traders to connect and learn from more experienced traders.

7. Support

Although many traders may think it is not important, customer support is very important for handling sticky situations. Given that the cryptocurrency space is still developing, many traditional investors are still confused about how this asset class works. Excellent customer support from a broker can make this process easier and seamless. Many brokers now offer support in multiple languages. You should also look out for 24/7 technical support, especially on weekends when you may want to trade.

8. Ease of use

The ease of use of a trading platform is also important. Can you find your way around the trading platform quickly and easily? Can you complete tasks in a timely manner and take advantage of market trends? Given that we are now busier than ever, this can be a major challenge if the trading platform is not user-friendly. Whichever broker you choose to work with, it must be user-centric and make the trading experience easy and smooth.

Cryptocurrency exchanges can also be used to buy Ethereum (ETH), currency trading is serious business. Many trading platforms are popping up every day with various offers. You need to know how to filter out the reliable platforms from among them.

It can be difficult to identify a highly credible broker from a less credible one. Review sites will help you in this regard as they will go into detail about the details and offers of a particular broker. Also, comparing parameters will make it easier for you to compare the two platforms and understand their pros and cons. Another benefit is that you will get to know whether a broker is a scam or legit, which is very important if you intend to avoid bad actors stealing your funds.

Which cryptocurrency to buy in 2024?

Both large and small cryptocurrencies have experienced exponential growth in the past six months, making it difficult to decide which cryptocurrencies to buy. While Bitcoin still leads the emerging industry, several crypto protocols have also attracted investors' attention due to their value proposition or user adoption.

However, choosing the best cryptocurrency ultimately depends on you. If you are a value-driven investor who wants to buy low and sell high, then some small-cap cryptocurrencies may be more suitable for your budget. Another indicator may be the future value proposition of a project.

The higher the usage and adoption of a crypto asset, the greater its growth potential. At the same time, relying solely on a crypto project's white paper and claims will most likely not bring returns. A good way to stay informed about market developments and trend changes is to read review sites such as InsideBitcoins, which have a team of experts who are familiar with the inner workings of the crypto market and can provide you with the safest advice.

We recently wrote about the cheapest cryptocurrencies to buy, as well as a new cryptocurrency that a Reddit user was interested in.

Bitcoin

Bitcoin is a well-known digital currency. More than 95% Americans equate the cryptocurrency market with Bitcoin. In a sense, this is correct, as this oldest cryptocurrency has occupied a major position in the emerging industry. Launched in 2009, Bitcoin was born based on the white paper published in 2008 by the mysterious founder Satoshi Nakamoto. It is the largest cryptocurrency and currently the most valuable cryptocurrency.

Since its launch, it has grown by more than 90,000,00% and has been widely adopted by retail and institutional investors, as well as governments around the world. Despite its huge success, Bitcoin is also the most criticized cryptocurrency for many reasons:

Environmental issues, the inability of governments to influence the policies of the Bitcoin network, volatility, and criminals using it to move money.

Bitcoin (BTC)

price

$42,803.00

Market Cap

836.72 B USD

Meanwhile, Bitcoin’s pace has not slowed down, and 2021 is its big explosion. Bitcoin was just over $30,000 at the beginning of the year, but rose to an all-time high of $64,350 in mid-April, and then hit another all-time high of $69,000 in November.

Although its value has since fallen by half, Bitcoin still accounts for the largest trading volume and tops the list of global cryptocurrencies. If you want to add this top crypto asset to your portfolio, you can read our guide on how to buy Bitcoin.

Ethereum

Besides Bitcoin, Ethereum is the only cryptocurrency that holds a significant position in the crypto industry. With a market share of 16.4%, Ethereum is a popular decentralized applications (dapps) platform founded by a team of software engineers and scientists led by Russian-Canadian Vitalik Buterin.

Although most of its early founders have left to form independent crypto projects, Ethereum remains the best-known dapps platform and the official home of the burgeoning decentralized finance (DeFi) sector. It’s also the center of the Metaverse — see our list of the best Metaverse coins.

Ethereum (ETH)

price

$2,313.89

Market Cap

277.92 B USD

Although Ethereum has been criticized for its high gas fees and network congestion, there are still more than 200 DeFi protocols actively trading on its blockchain. With the exponential growth of DeFi projects, Ethereum's influence continues to grow. It once soared to an all-time high of $4,350, but due to market pressure, its value fell by more than 50%. However, by the end of this year, Ethereum may change its fate once it switches to the less energy-intensive Proof of Stake (PoS) protocol.

If you want to learn more about the Ethereum project, you can check out our guide on how to buy Ethereum.

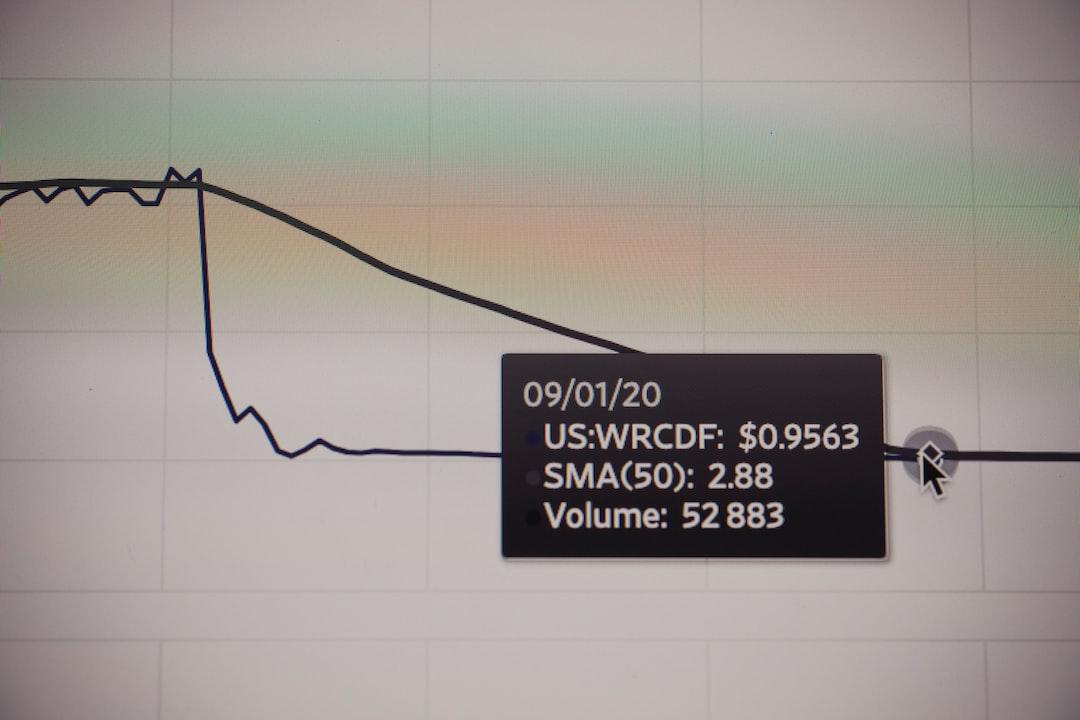

Dogecoin

Dogecoin, the meme-based cryptocurrency, has had a stellar year. Although it has yet to break the $1 mark since its launch in late 2013, the parody coin has come close to doing so. Soaring to an all-time high of $0.74 amid the cryptocurrency boom, Dogecoin is up 150,001 tp3t this year. Its astonishing gains have given the parody coin pop-star status, attracting celebrity endorsements and spawning a slew of dog-themed cryptocurrencies.

Dogecoin (DOGE)

price

$0.091

Market Cap

12.98 B USD

Despite having no general use case beyond Shiba Inus (not to be confused with another similarly named crypto project), Dogecoin continues to make waves and has temporarily surpassed Ford Motor and Twitter in market cap.

The price of Dogecoin is well below its all-time highs, and it still has a lot of potential in the market, with Tesla boss Elon Musk planning to make it the interstellar currency of the future. In our guide on how to buy Dogecoin, we detail some of the market movements of Dogecoin.

Binance Coin (BNB)

Known as BNB for short, the digital token is associated with a centralized cryptocurrency exchange called Binance Holdings. It plays multiple roles in the rapidly expanding Binance ecosystem and enables its holders to enjoy lower fees on Binance-owned platforms.

Among other things, this proprietary coin is used to settle purchases of online services, ticketing, and a variety of other purposes.

BNB may not be a top crypto project, but its rise has been nothing short of remarkable. BNB started the year at just over $40, but surged to $650 during the crypto frenzy of May. This made it the fourth-largest cryptocurrency by market cap, a position it has maintained for most of the year. BNB burns every quarter, gradually increasing the value of its 200 million tokens. Meanwhile, currently trading below $350, it could be a good time to buy this BEP-20 token.

Cryptocurrency Presale

New cryptocurrency ICOs, private sales or pre-sales offer the opportunity to buy at the lowest price and therefore have the highest upside potential.

Some of the most promising crypto assets we’ve reviewed are those that are about to launch, because as a trader, it’s crucial to buy low and sell high. Check out our full list of the best cryptocurrency launches that are early in their roadmaps.

Alternatives to Bitcoin

There is no doubt that Bitcoin is the premier digital asset and there is hardly any crypto protocol that stands a chance of overtaking its first position in the cryptocurrency rankings. However, 2024 sees many crypto assets making bold entries in the crypto space. With several digital assets achieving significant growth, investors are looking for small-cap cryptocurrencies with growth potential.

In this section, we will briefly explore five such encryption protocols:

AAVE

AAVE is the digital token of a crypto lending protocol that has performed well this year. With the help of this protocol, cryptocurrency holders can earn passive income by lending their cryptocurrency holdings. AAVE is the most valuable protocol in the booming DeFi market, with a controlling share of 16.64%.

Read our list of Best DeFi Coins to Invest in, one of which is AAVE.

The growth indicators of the AAVE token show that it rose from $88.05 on January 1 to $643.07 on May 18, an increase of more than 40,00%. Despite its decline in value, AAVE remains a crypto asset worth watching and could become the next Bitcoin in the emerging DeFi sub-industry. For more information, read our guide on How to Buy AAVE.

DOT

Polkadot is a multi-chain heterogeneous solution founded by Gavin Wood, the former CTO and co-founder of Ethereum, and is the result of Ethereum's dream of building an interoperable and scalable network. Dubbed the "Ethereum killer" from the beginning, it has not disappointed its supporters.

It proved the predictions of its supporters correct, entering the top ten most valuable cryptocurrencies and making significant progress towards its goal of achieving an interconnected blockchain ecosystem. The DOT token has shown volatile price action like most cryptocurrencies, but it has been able to hold its head. From $8.88 at the beginning of the year, DOT has grown more than 2,00% to a high of $48.36 on April 14.

ADA

ADA is another popular “Ethereum killer” that has a history with the popular dapps platform. ADA is the digital token of the Cardano network, which is developed by Hong Kong software company Input Output Hong Kong (IOHK) and Emurgo. Cardano is a Proof-of-Stake (PoS) blockchain network that uses a mining protocol called Ouroboros to validate transactions on its protocol. The advantage of the Cardano network is that it is still under development, but the project has quickly attracted the attention of investors because it has a high value proposition.

Cardano aims to build a new financially inclusive ecosystem where anyone can participate without fear of censorship. With its promise of low fees and interoperability, Cardano’s ADA has been one of the best performing crypto assets in recent months. It rose from a valuation of less than a dollar to over $2.45 in May.

Cardano’s low price and future potential make it a good investment opportunity for any investor. To learn more, read our How to Buy Cardano guide.

SOL

Another potential blockchain protocol to replace Bitcoin is Solana. Also known as the "Ethereum killer," Solana is a permissionless, open-source crypto platform that enables DeFi solutions. It claims to be faster than the Ethereum network in verifying transactions and can process 50,000 transactions per second. Solana uses an innovative consensus algorithm PoH (Proof-of-History) and a Proof-of-Stake (PoS) protocol, and its adoption is increasing as more and more DeFi projects migrate their services to the Solana network.

As DeFi continues to grow exponentially in the sub-sector, Solana may soon challenge the Ethereum network as one of the best platforms to build DeFi protocols. Solana’s SOL token has also shown positive price action, growing from $1.8 to a record high of $55.91. It is expected to continue to rise despite the market decline.

Cryptocurrency Signals

See also our guide to the Best Cryptocurrency Trading Signals. These automated crypto buy and sell signals are a low-risk alternative to trading cryptocurrencies, with a team of professional traders providing trade setups and investment strategies.

Taxes on cryptocurrency gains

Different government agencies classify crypto assets differently. Some countries consider them commodities, while others consider them securities.

However, most tax agencies are stepping up their efforts to capture revenue from the booming crypto space. The U.S. Internal Revenue Service (IRS) considers cryptocurrencies “property,” making them subject to capital gains taxes.

At the same time, they are sometimes considered income and are subject to income tax laws. In the United States, the following cryptocurrency trading activities are considered capital gains taxable events:

Convert cryptocurrencies to fiat currencies

Pay for goods and services with cryptocurrency

Exchange one crypto asset for another through an exchange or peer-to-peer channel

The following are taxable events for income from cryptocurrency:

Airdropped Cryptocurrency

Income from lending on DeFi platforms

Block rewards obtained through mining

Cryptocurrency income from staking and liquidity pools

Pay with cryptocurrency

However, you can still use the losses to offset your capital gains tax obligations. When you hold crypto assets for the long term, you can even save up to $3,000 on income taxes.

Calculate your capital gains tax

The total amount you will pay to trade cryptocurrencies or own digital assets depends on how long you hold them. This will largely determine how much you will need to pay:

Short-term capital gains

If you started trading cryptocurrencies less than a year ago, your gains or losses will be taxed at your normal ordinary income rate and subject to short-term capital gains taxes. However, your losses can help you offset up to $3,000 of taxable income. You can also carry forward these losses to the next year.

Long-term capital gains

Long-term capital gains are different from short-term capital gains. If you hold crypto assets for more than one year, you may be taxed at 0%, 15%, or 20%, depending on your income. You can see the revised list from the IRS here.

How to Invest in Cryptocurrency Responsibly

The cryptocurrency market has been on an upward trajectory since Satoshi Nakamoto launched Bitcoin in 2009. At the same time, this first-ever cryptocurrency has grown by more than 90,000,00% since its inception, leading this emerging industry to unicorn status in the shortest possible time. This remarkable achievement has attracted both retail and institutional investors to join and study how to enter the cryptocurrency market.

However, investing in cryptocurrencies comes with its own risks. Here are a few things to keep in mind when trading digital assets:

Continuing Research

The cryptocurrency space is an ever-evolving one, with new crypto and Web3 projects emerging every day. To get the best returns, you need to stay up to date with the latest market trends and movements through research.

Social media channels have a great influence on cryptocurrencies, and you can take advantage of social trends and profit before the market pulls back. You can also follow crypto market news on major financial channels and listen to expert analysis of cryptocurrencies. InsideBitcoins is one such review site that will provide you with the latest updates on Bitcoin and the best alternative cryptocurrencies.

Limiting risk exposure

Cryptocurrency prices are notoriously volatile, meaning they can skyrocket or plummet in a matter of hours. If the market moves against you, make sure to withdraw your investment promptly to limit your risk exposure.

Don't rely on the idea that it will go up immediately. It may take days or even months before the bears lose their grip on the market. Always remember that cryptocurrencies are high-risk high-reward assets, invest money you can afford to lose.

Should you buy or trade cryptocurrency?

You may want to consider factors such as your budget, time constraints, and risk tolerance. If you want to day trade, trading small cryptocurrencies with low market capitalizations may be more suitable for you. However, if your investment strategy is more long-term, you may consider buying more established crypto assets such as Ethereum.

There are some differences between these two strategies. Buying is a medium- to long-term investment with lower risk and lower returns, you buy and own the underlying asset and can make payments with it. Trading cryptocurrencies is a short-term investment with higher risk and higher returns, you own virtual contracts for difference (CFDs) instead of the underlying asset and speculate on price movements.

Cryptocurrency News - Latest Updates for January 2024

Coinbase’s Brain Hole: The Rise of Base Chain in Ethereum’s Second Layer Competition

FTX founder Bankman-Fried seeks court assistance in legal woes

Coinbase suspends certain stablecoin trading in Canada

According to the monthly chart from Tradingview, the total crypto market cap is $1.14 trillion in August 2023 and dropped to the trillion-dollar region following rumors of Elon Musk’s SpaceX selling its Bitcoin holdings.

The year-end value of 2022 was $2.19 trillion, while the year-end value of 2021 was $76 billion. Therefore, the valuation of the crypto market increased hundreds of times in 2021, and then fell by more than 50% in 2022. Many analysts predict that the crypto bull run will continue after the Bitcoin halving in the fourth quarter of 2023 or May 2024.

Our Beginner's Guide to Cryptocurrency

Now that you know more about how to buy crypto safely, check out our other beginner’s guides:

AltIndex Comments

Best AI Cryptocurrency

Best Arbitrum Network Coin

Best Cryptocurrencies for Beginners

Best Bitcoin Mining Pools Sites

Best Blockchain Game

Best BSC Tokens

Best PancakeSwap Coins

Best Uniswap Coins

Best Cryptocurrency Airdrops

Best Cryptocurrency Courses

Best Crypto Crowdfunding

Best Cryptocurrency Private Placement

Best Cryptocurrency ICOs

Best Cryptocurrency IDO

Best Cryptocurrency IEOs

Best Cryptocurrency Fields

Best Cryptocurrency STOs

Best Cryptocurrency Trading Bots

Best Crypto Twitter Accounts

Best Cheap Cryptocurrency

The most promising cryptocurrencies for investment

The most valuable cryptocurrency to invest in

The most sustainable cryptocurrency

The most trending cryptocurrency projects

The lowest valued cryptocurrency

The most volatile cryptocurrencies

The next big cryptocurrency

The next cryptocurrency to explode

New Cryptocurrency Listings

New ICOs coming soon

NFT Airdrops

P2B Reviews

Cryptocurrencies on the rise

Should you buy Bitcoin now?

Is it too late to buy Ethereum now?

Is it too late to buy XRP now?

TG.Casino Token Price Prediction

The biggest gainers

Popular DEXTools Cryptocurrencies

Upcoming Binance Tokens

Difference between wETH and ETH

Bitcoin Game Theory

When and how to buy Arbitrum

Where and how to buy ARKM

Where and how to buy things with Bitcoin

Who accepts Bitcoin?

Who accepts Dogecoin?

Yield App Review

in conclusion

The cryptocurrency market is an exciting area to invest in. Cryptocurrencies are fast-growing digital currencies that are seen by many as the future of money.

Crypto assets are also highly volatile, meaning they can experience wild swings. Before investing in cryptocurrencies, check out review sites like Inside Bitcoins, do your own research, and consider regular cumulative investing (DCA) rather than going “all in” at once.

Many trading platforms and exchanges offer cryptocurrencies, and you may want to open accounts on several platforms to diversify your portfolio and take advantage of different features such as crypto staking.

Coinbase is our recommended cryptocurrency broker.

Frequently asked questions

How do I buy cryptocurrency?

There are several ways you can buy the cryptocurrency you want. One way is to use a cryptocurrency exchange like Binance. However, most cryptocurrency exchanges are not regulated, which poses a risk to your investment. Another way is to buy through a traditional trading platform that offers cryptocurrency services and has obtained a financial services license.

How do I sell cryptocurrency?

There are many ways you can sell your crypto assets, but we recommend selling them through the platform you originally purchased them from. This ensures you get your funds back and avoids any bad actors.

Where to buy cryptocurrency?

Since many trading platforms now offer cryptocurrency services, choosing where to buy cryptocurrency can be difficult. However, some of the most well-known platforms are Binance, Coinbase, and the others reviewed in this guide. All of these exchanges offer different packages, and you need to compare them to see which platform is best for you.

Which brokers are best for buying cryptocurrencies?

Our most recommended brokers for buying cryptocurrencies are Coinbase, Huobi, and Crypto.com.

What payment methods can I use to buy cryptocurrencies?

There are many payment methods for buying cryptocurrencies. You can buy cryptocurrencies using credit/debit cards, Paypal, Neteller, Skrill, Sofort, and bank wire. This depends on the platform you are trading on.

What is a cryptocurrency exchange?

A cryptocurrency exchange is a trading platform that allows you to buy and sell cryptocurrencies. It operates like a traditional exchange, where you will trade using analytical tools, perform technical analysis, view order books, and place trades. Exchanges like Binance also offer financial services like earning interest on your crypto savings and borrowing money.

What is a Bitcoin Exchange?

A Bitcoin exchange is another name for a cryptocurrency exchange.

How do Bitcoin exchanges work?

A Bitcoin exchange operates in a similar way to NASDAQ. It facilitates transactions between buyers and sellers, albeit in cryptocurrencies. Bitcoin exchanges operate on the same model as brokerage firms, and you can fund your account through bank transfer or other methods. However, you will need to pay a fee.

Is it safe to buy cryptocurrency?

Buying from a regulated entity like Coinbase is safe and you can rest assured that no bad actors will steal your funds.

Which cryptocurrency should I buy or trade?

You may want to consider factors such as your budget, time constraints, and risk tolerance. If you want to day trade, trading small cryptocurrencies with low market capitalizations may be more suitable for you. However, if your investment strategy is more long-term, you may consider buying more established crypto assets such as Ethereum.