Bitcoin exchange-traded funds (ETFs) generated $1.8 billion in trading volume on January 16, three times the volume of all 500 ETFs launched in the United States on the same day. In the first three days of trading, new Bitcoin ETFs have accumulated $10 billion in trading volume, led by BlackRock, Grayscale and Fidelity.

Bloomberg ETF analyst Eric Balchunas said in an X post: "Let me explain how crazy $10 billion in volume in the first three days is. There are 500 ETFs launched in 2023. Today, their combined volume is only $450 million. IBIT alone has more volume than the entire 23 year combined."

BlackRock, Grayscale, and Fidelity accounted for a staggering $1.6 billion of the $1.6 billion in volume traded on January 16. Among these ETFs, BlackRock's iShares Bitcoin Trust was the clear leader in terms of attracting net inflows. Over the past three days, the fund has attracted more than $497 million in inflows. Grayscale's Bitcoin Fund maintained its lead in terms of trading activity, with more than $5.1 billion in volume. However, the fund experienced considerable outflows, with investors likely seeking lower fees on new products. Since it began trading on January 11, Grayscale's Bitcoin Trust (GBTC) has seen a total outflow of more than $579 million.

On X, Balchunas predicted in a Jan. 16 update that BlackRock’s ETF will continue to attract the most inflows. This will then allow it to “surpass GBTC as the liquidity king,” he added.

BlackRock woos wealthy, older investors

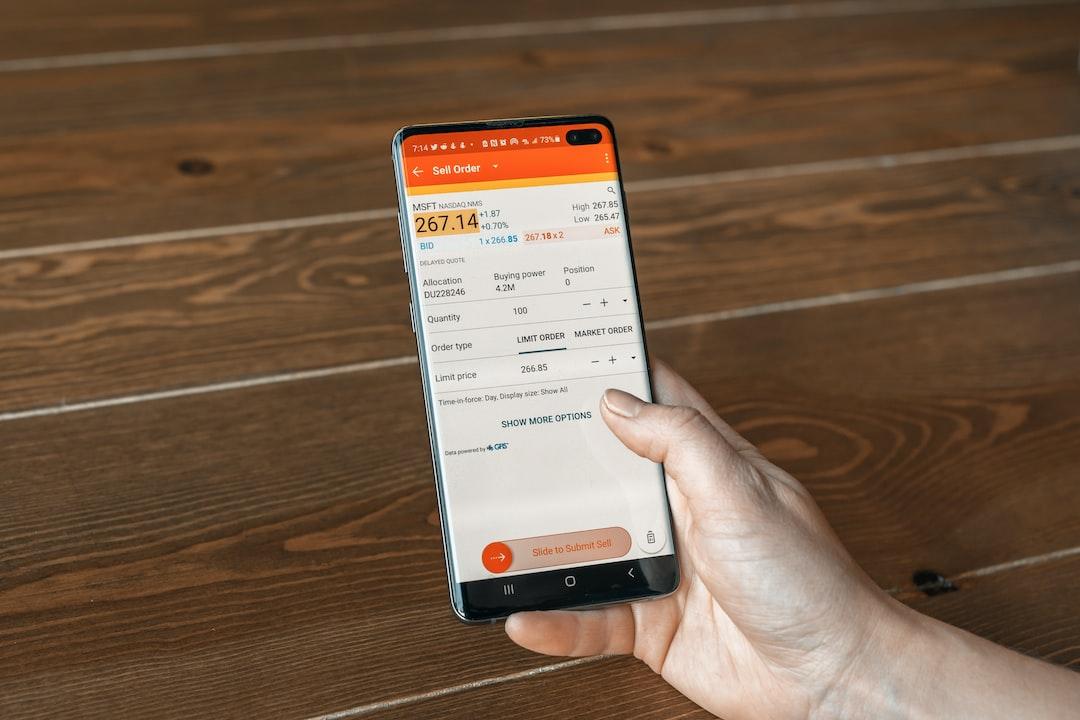

BlackRock’s early success in the bitcoin exchange-traded fund market could be attributed to its simple advertising approach to attract wealthy baby boomer investors. Many analysts and investors praised the success of the world’s largest asset manager’s “boring” ads to a mature, wealthy audience.

In a nearly two-minute video ad, Jay Jacobs, BlackRock's head of U.S. thematic and alternative ETFs, outlined Bitcoin's value proposition. The executive also explained how BlackRock's ETFs allow investors to gain exposure to Bitcoin. After the ad was released, BlackRock's Bitcoin exchange-traded fund recorded more than $1 billion in trading volume on its first trading day.

Related articles:

New Cryptocurrency Releases, Listings and Presales Today - Crowdchain, Xpense, SPACE DRAGON

BRC-20 Tokens Become Hottest Cryptocurrency Sector in Bitcoin’s ‘New Era’

Upcoming Cryptocurrency Presales: Unlock Early Investment Opportunities!

New Cryptocurrency Mining Platform - Bitcoin Minetrix

Audited by Coinsult

Decentralized and secure cloud mining

Get free Bitcoin every day

Native token presale is in progress - BTCMTX

Savings Rewards - APY over 100%

learn more

Join our Telegram channel to get the latest news in a timely manner